Starting a business in Nigeria can be a challenging endeavour, particularly when it comes to obtaining the required funding. Even though there are various government-owned loan programs for Businesses, it’s quite difficult for the masses to acquire the loans because of the stringent application processes, and lack of transparency, amongst others.

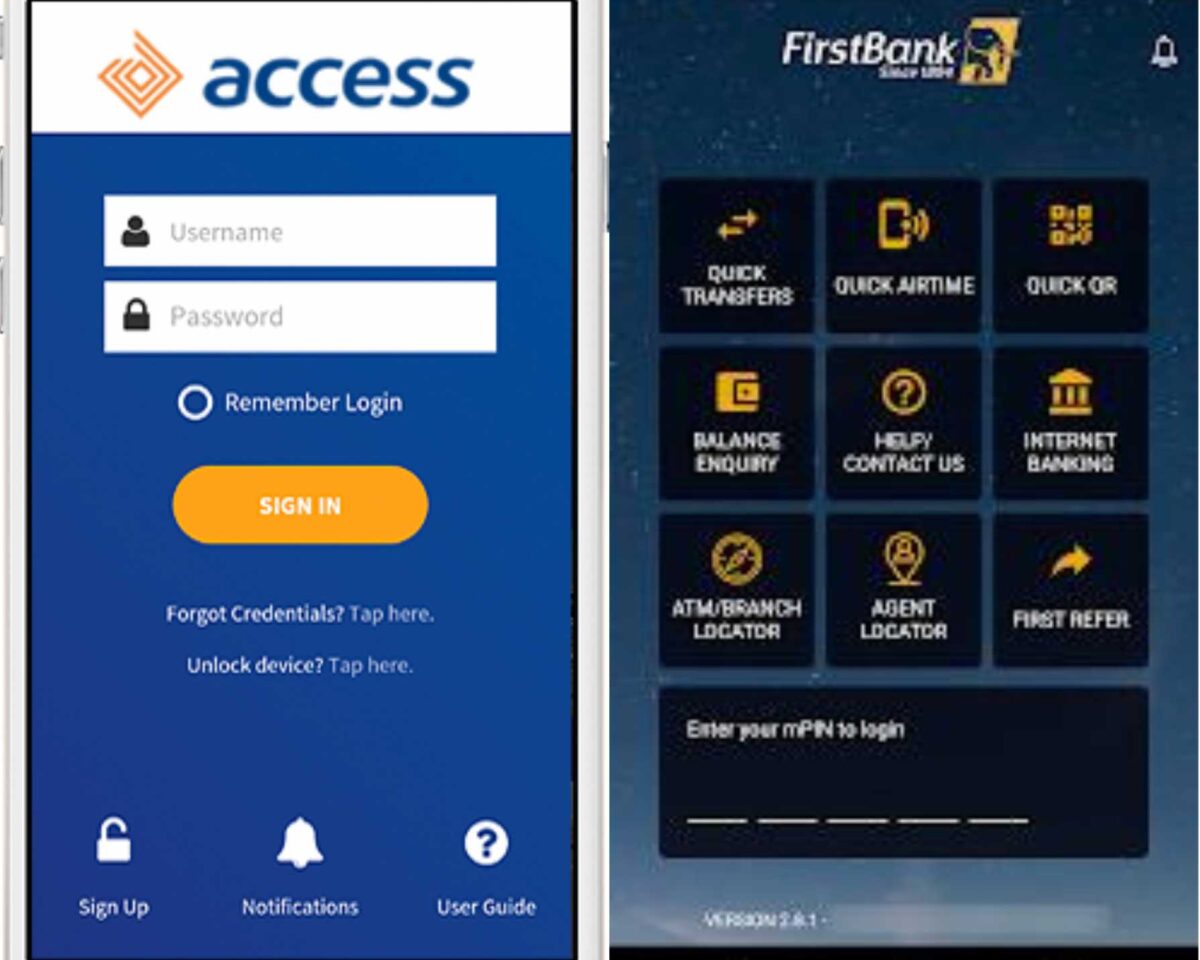

Hence, Businesses often turn to commercial banks for help, and many of these Banks have proven to be a saving grace for Businesses. If you have a Business in Nigeria and want to choose between Access Bank and First Bank loan products, this post is for you.

Below is an in-depth comparison of these two ‘big’ banks’ loans for businesses. This article discusses the eligibility criteria, interest rates, repayment terms, additional support services, and pros and cons.

Access Bank Loans for Business Owners

Access Bank offers multiple loan products to their customers. The type of loan given to Entrepreneurs is the Instant Business Loan.

What is the Instant Business Loan?

Access Bank’s Instant Business Loan is a digital financing product designed to empower SMEs by providing them with the necessary funds to start or sustain their business operations for a short period.

Subject to the Bank’s risk acceptance criteria (RAC), this program has helped countless entrepreneurs establish and grow their firms.

Eligibility Criteria

Below are the documents and conditions you must meet to acquire the Access Bank Instant Business Loan:

- Certified Business Company

- Evidence of MEMART (i.e Legal documents that clearly state the company’s objective, shareholders’ name and number, and policies)

- BVN and TIN of the company’s owners and affiliates.

- Your business must be at least a year old.

- A three-month-old active Access Bank account.

- No pending loan

- Impressive credit record

Loan Amounts and Interest Rates

The amount depends on business revenue— because you can only receive 50% of your monthly average turnover. It means your monthly income is a significant factor in determining the maximum amount.

Meanwhile, the table below contains some turnovers and their corresponding loan limit.

| Average Monthly Turnover | Maximum Limit |

|---|---|

| ₦500,000 – ₦2,499,999 | ₦1,000,000 |

| ₦2,500,000 – ₦4,999,999 | ₦2,000,000 |

| ₦5,000,000 – ₦9,999,999 | ₦3,000,000 |

| ₦10,000,000 – ₦24,999,999 | ₦4,000,000 |

| ₦25,000,000 – ₦49,999,999 | ₦25,000,000 – ₦49,999,999 |

| >₦50,000,000 – ₦59,999,999 | ₦6,000,000 |

| ₦60,000,000 – ₦69,999,999 | ₦7,000,000 |

| ₦70,000,000 – ₦79,999,999 | ₦8,000,000 |

| ₦80,000,000 – ₦89,999,999 | ₦9,000,000 |

| ₦90,000,000 – ₦100,000,000 | ₦10,000,000 |

Note that you can’t get more than ₦10 million, regardless of your average monthly turnover or cash flow.

Interest Rates

Instant Business Loan attracts a 10% interest rate on every amount you receive. Let’s say you borrowed ₦1,000,000, you are expected to pay ₦100,000 as interest.

Apart from the interest, other charges include a 1% management fee, 1% advisory fee, and 0.9% insurance cover, which are taken upfront.

Repayment Terms

The repayment terms and conditions are clear. Since the loan tenure is six months, you must repay the debt within the time frame to avoid extra charges and legal sanctions.

Application Procedure

You can request for Access Bank Instant Business Loan through the following process:

- Download the QuickBucks app

- Login to your access account

- Follow subsequent instructions

Pros

Below are some benefits of the Access Bank instant business loan:

- Fair interest rate

- Quick approval and disbursement process. It takes only two (2) to five (5) working days.

- The loan is accessible to eligible customers.

Cons

- In case of a huge loan amount, the loan tenure might be too short.

- Businesses in the Oil & Gas, Construction, Real Estate, and Education sectors are ineligible.

First Bank Business Loan

First Bank also offers multiple financial aids to launch your company and boost its growth over a while. A major one is the First Bank FirstCredit.

What is the First Bank’s FirstCredit Loan?

It is a loan product that gives small and medium-scale enterprises a small sum of money for their first transactions.

While Access Bank’s Instant Business Loan caters to a broader range of SMEs, First Bank’s FirstCredit Loan is specifically tailored to entrepreneurs seeking to launch or sustain small businesses or micro-enterprises.

Eligibility Criteria

Below are the requirements and documents you need to qualify for this loan:

- A six-month active First Bank account

- A valid BVN

- Impressive loan record

- Regular transactions in the past six months.

Loan Amounts and Interest Rates

Amounts are directly proportional to your account activities. The more transactions you make, the higher the amount. You can get up to ₦300,000.00 if you use your account often.

Interest Rates

FirstCredit has a flat interest rate of 8% on any amount. There’s also a 5% insurance fee per transaction.

Repayment Terms

You have 30 days to repay your loan. What happens if you miss the repayment deadline? You will pay default fees and be ineligible for future loans.

Application Process

Interestingly, you can apply for this loan via the USSD code. Follow these steps to apply:

- Dial *894# on your registered mobile number

- Select Loan

- Select FirstCredit

- Provide your account number

- Press 1 to continue

- Choose your desired loan amount

- Input your USSD 5-digit PIN

Pros

- It’s suitable for low-scale business owners

- Instant disbursement

- Easy application process

- No collateral needed

Cons

- Loan amounts can be insufficient for large-scale launching.

- Short tenure

Access Bank Instant Business Loan Vs First Bank FirstCredit Loan: Quick Comparison

The table below is a brief comparison between both loans.

| Categories | Instant Business Loan (Access Bank) | FirstCredit Loan (First Bank) |

|---|---|---|

| Maximum Amount | ₦10,000,000.00 | ₦300,000.00 |

| Disbursement/Approval | 2-5 workdays | Immediately |

| Collateral | Compulsory | Not needed |

| Loan Tenor | Six months | 30 Days |

| Application | Cumbersome | Easy and fast Ussd |

| Interest Rate | 10% | 8% |

Final Verdict

In your quest for a Business loan, you should know that there is no one-size-fits-all solution. What works for one entrepreneur might not work for another.

So, it’s advisable to carefully consider your business size, industry, target market, and budget before choosing between Access Bank’s Instant Business Loan or First Bank’s FirstCredit Loan.

Sources

https://www.accessbankplc.com/personal/borrowing/small-ticket-personal-loans

https://www.firstbanknigeria.com/personal/loans/firstcredit

https://www.accessbankplc.com/personal/borrowing/advance-for-school-fees