Access Bank and Guaranty Trust Bank are some of the most famous financial institutions in Nigeria. Both banks have a large customer base and offer various customer-centric products to their customers.

If you’re here because you are looking to choose either of these two banks for your business or personal transactions, you’re in the right place. Read on as we explore the history, products, services, strengths, and weaknesses of GTBank and Access Bank. In the end, you should have garnered sufficient information to help you make an informed decision.

GTBank Products and Services

Guaranty Trust Bank, known as GTbank, is one of the leading banks in Nigeria. Founded in 1988 by Tayo Aderinokun and 29 other young Nigerians, the financial institution is a go-to option for Nigerians looking for customer-centric and secured banking services.

Below are the products and services offered by the financial institution:

Personal Banking

GTBank offers a wide range of personal banking products and services, including current and savings accounts, loans, credit cards, and investments. Below is a quick rundown of personalized services available to GTBank customers:

- GTPatriot: For Military and Paramilitary personnel in Nigeria to enjoy subsidized bank charges.

- GTSave: Customers earn daily interest on every money deposited.

- GT Target: High-interest accruing account that encourages savings.

- Smart Kids Save (SKS): For parents to save for their kids.

Business Banking

GTBank has multiple products and services for small and medium-sized enterprises (SMEs). These include business accounts, loans, trade finance, and advisory services. They often organize seminars where top-class entrepreneurs share and gain more business ideas.

Corporate Banking

GTBank’s corporate banking division caters to the needs of large organizations by offering business-oriented services such as:

- Tenured Deposits

- Cheque Writing

- Portfolio Management

- Corporate Advisory Services

- Project Finance

With these services, young and established entrepreneurs can successfully run their businesses without glitches.

Investment Banking

Like many commercial banks, GTBank offers multiple investment opportunities for customers. However, you can only invest by depositing a specific amount into your fixed and tenured deposit account at an agreed interest rate. You will get your principal and interest at the end of the time frame.

Digital Banking Solutions

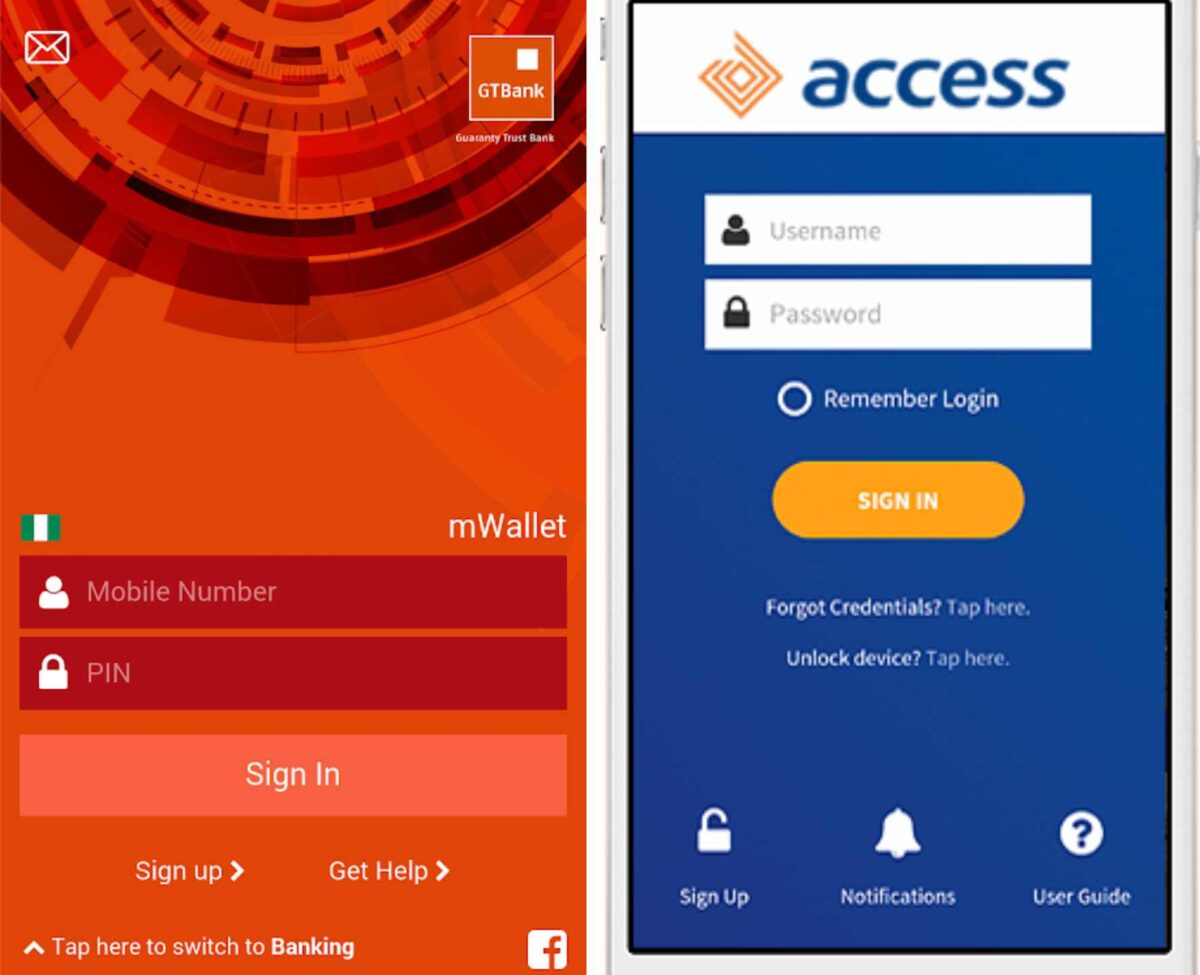

GTBank has been at the forefront of digital innovation in the Nigerian banking sector. It’s one of the first institutions to adopt mobile and internet banking for more convenience.

Strengths

Below are some of the attributes that have earned GTbank accolades, customers, and fame over the years:

- Strong brand reputation

- Innovative digital banking solutions

- Impressive risk management

- Skilled and experienced team of professionals

Weaknesses

- Relatively high charges compared to some other competitors

- Services unavailable in rural areas

- Long queues in physical branches due to lack of enough service outlets to attend to their numerous customers

Access Bank Products and Services

Access Bank was founded in 1988 as a corporate finance institution but wasn’t globally recognized until 2002. The bank hasn’t looked back since it obtained the universal banking license but has forged ahead to seal its position as one of Nigeria’s largest banks through strategic acquisitions such as merging with Diamond Bank in 2019.

Access Bank offers almost the same products and services as GTbank. The bank ensures that customers have access to Personalized Banking Services like easy-to-create accounts (Savings, Current, and Fixed), mortgages, credit cards, and investment opportunities.

The table below contains the types of Access Bank Saving Accounts you can explore:

| Instant Savings 1 | Instant Savings 2 | Premier Savings |

|---|---|---|

| 1,000 minimum account opening balance | NGN1,000 minimum account opening balance | Minimum opening balance of N1,000 |

| Issuance of Verve cards (only) | Issuance of Verve cards (only) | Different Debit Card based on the customer’s preference |

| Interest rate of 6.825% p.a. (per annum) | Interest rate of 6.825% p.a. (per annum) | Interest rate of 6.825% p.a. (paid monthly) |

| ₦50,000 Maximum single deposit | 100,000 Maximum single deposit | ₦2,000,000 maximum Cheque deposit |

| ₦300,000Maximum cumulative balance | ₦500,000 maximum cumulative balance | ₦50 monthly maintenance fee |

| Transactions are limited to Nigeria | Transactions are limited to Nigeria |

Access Bank also provides various options for business owners seeking financial aid and support. You can open corporate or business accounts, apply for loans, and enjoy other benefits limited to entrepreneurs and CEOs.

Access Bank launched its mobile app a long time ago even before GTBank to provide easy and fast banking options to eligible customers.

Strengths

- Access Bank has the second-largest physical presence in Nigeria.

- It has customer-centric services.

- Safe and secure mobile app

Weaknesses

- Not too impressive customer support based on online reviews

- Tends to have a higher non-performing loan ratio TBA than many other banks

Comparison: GTBank vs Access Bank

Let’s do some quick comparisons

Personal Banking and Interest (Savings and Interest Rates)

| Guaranty Trust Bank | Access Bank |

|---|---|

| GTSave (5.55% interest rate) | High Interest Deposit Account (Interest ranges from 6.825% p.a. to 9.75% based on your amount) |

| GTPatriot (Undisclosed rate/attractive) | Instant Savings 1 (6.825% p.a.) |

| GT Target (5.25% rate) | Instant Savings 2 (6.825% p.a.) |

| Smart Kids Save (5.25%) | Premier Savings (6.825% interest, paid monthly) |

| Diaspora Savings (5.625% p.a. ) | |

Observation: GTBank seems to have more saving options than Access Bank but Access Bank offers better interest rates.

Charges and Fees

| Charges (Fee) | GTBank | Access Bank |

|---|---|---|

| Maintenance/service | 5 withdrawals in one month attracts ₦1/mille. Dollar account maintenance fee is $10 annually | ₦1/Mille $10 Dollar account |

| Withdraw on Other Bank’s ATM | ₦60 | ₦35 |

| Transactions Fee | Transfers below N5,000 will attract a charge of N10 plus 7.5% Vat Transfers from N5,001 – N50,000 will attract a charge of N25 plus 7.5% Vat Transfers above N50,000 will attract a charge of N50 plus 7.5% Vat | Same charges as GTbank |

| SMS | ₦ 4 | ₦4 |

| Debit card Issuance | ₦1000 | ₦1000 |

| POS Charges | 0.5% of the principal amount | 0.5% of the principal amount |

Which Bank is Right for You?

Let’s wrap this post up here. The answer to the above question depends on what you want. However, here are some helpful tips:

For Personal Banking Needs

Access Bank is recommendable due to its seamless accessibility. With over 530 branches in Nigeria, you can easily walk into any branch, create an account, and resolve any issue.

For Business and Corporate Banking

GTBank. They have massive packages for entrepreneurs and CEOs.

For Investment and Wealth Management

You can choose any of the two. They both have good offers in this aspect.

For Digital Banking Priorities

According to customers’ reviews and personal observations, the GTBank mobile app is quite intuitive and easy to navigate than the Access Bank mobile app.

Sources

https://www.accessbankplc.com/personal/diaspora-banking/savings-account

https://www.gtbank.com/personal-banking/loans

Don't miss a thing. Follow us on Telegram. If you love videos then also Subscribe to our YouTube Channel. We are on Twitter as MakeMoneyDotNG.