How to use Bybit trading bot to make money while you sleep

You might have seen how crypto has made many people rich. Despite people saying it will fade away, after 10 years, it is still going strong, setting new records every day.

It might be time to get in and be part of the success story. The good news is that crypto has advanced to the level that even if you are a beginner, you can use tools to trade and make money even while you sleep.

With the Bybit trading bot, making money with crypto while you sleep is not just a dream, it’s a real possibility. Trading bots are revolutionizing the way we trade, letting you earn profits around the clock without needing to watch the markets nonstop. In this guide, I’m going to show you how to use the Bybit trading bot to make money even while you’re catching some sleep.

What Is the Bybit trading bot?

Bybit trading bot is an automated tool that trades for you on the Bybit exchange. You set the strategies and parameters, and it takes care of the rest, removing emotion and guesswork from the equation. Whether you’re just a beginner in crypto trading or you’re a seasoned pro, this bot helps you tap into market movements around the clock.

Bybit’s trading bot is super user-friendly and helps you make the most of market swings. It executes trades faster than any human could, so you won’t miss out on opportunities in the booming crypto world.

Why use a trading bot?

So, why bother with a trading bot? Let me give you the lowdown:

- Always on: Crypto markets never sleep, and neither does your bot. It keeps trading even when you’re working, relaxing or sleeping

- No emotions: Bots stick to the plan without getting caught up in fear or greed. They’re like the stoic traders we all aspire to be.

- Super fast: They crunch numbers and execute trades quicker than any human can. Think of them as your personal high-speed trading assistant.

- Consistent moves: By following your set strategies, bots provide consistent trading actions over time. No more second-guessing yourself.

- Saves you time: Let the bot handle the trading while you focus on other things in life—like finally taking that cooking class.

How to set up Bybit trading bot

Step 1: Sign up for a Bybit account

You must be a Bybit user to use their trading bot. Don’t have a Bybit account yet? No worries, it’s easy:

- Visit the Bybit website here

- Enter your email and set a password.

- Confirm your email address.

- Complete any KYC steps to access all features.

Step 2: Secure your account

Before diving in, make sure your account is locked down tighter than Fort Knox:

- Turn on Two-Factor Authentication (2FA): Adds extra security.

- Set up an anti-phishing code: Helps you confirm emails are really from Bybit.

Step 3: Add funds to your account

Ready to trade? Let’s get some funds in there:

- Log in to Bybit.

- Go to the “Assets” section.

- Pick the cryptocurrency you want to deposit.

- Click “Deposit” and follow the steps to transfer funds to your Bybit wallet.

- You can also buy by clicking “Buy Crypto”

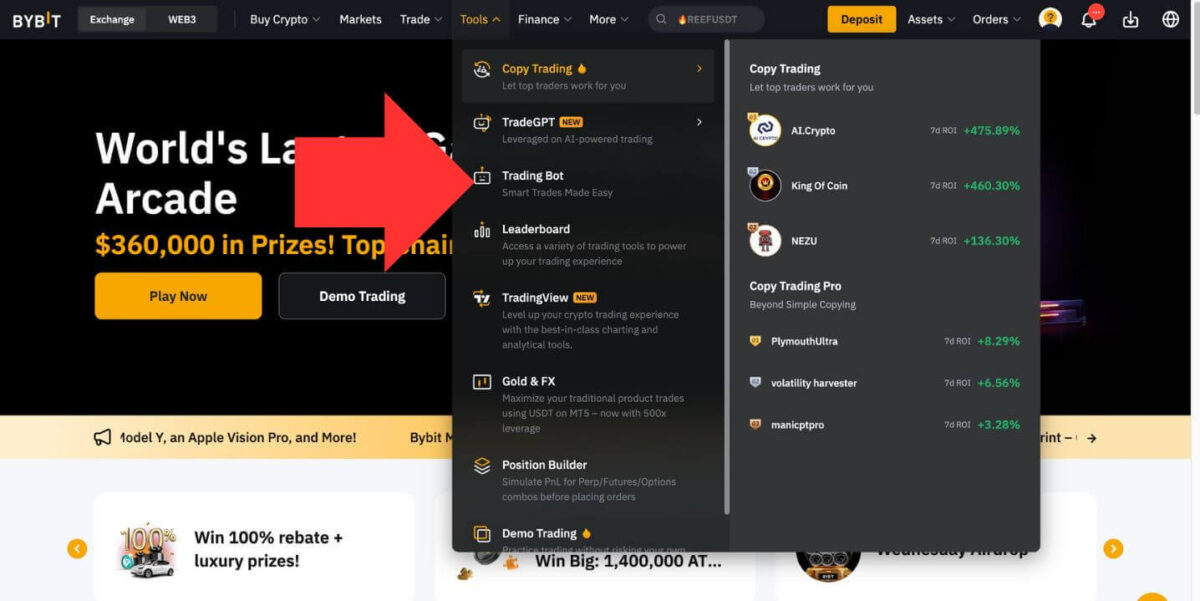

Step 4: Find the trading bot

With your account ready to go:

- Log in to Bybit.

- Head over to the “Trading Bot” section under “Tools” or “Trading.”

- You’ll see options like “Spot Grid Bot,” “Futures Grid Bot,” or “DCA Bot.”

- Or click here to go to the trading bot section.

Step 5: Pick your trading strategy

Bybit has several trading bots. Here are two crowd-pleasers:

- Grid Trading Bot: Sets up multiple buy and sell orders at intervals within a price range you choose. Great for profiting from market ups and downs.

- Dollar-Cost Averaging (DCA) Bot: Invests a set amount at regular intervals, helping to smooth out the effects of market volatility over time.

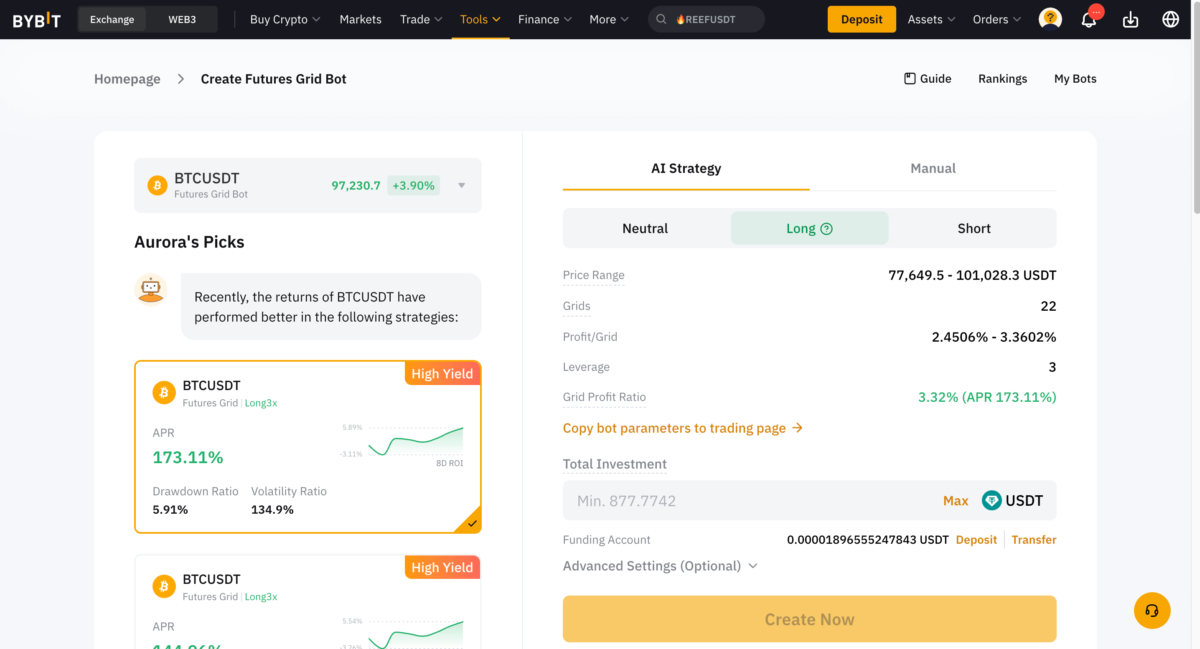

Step 6: Set up your Bbot

Let’s get your Grid Trading Bot up and running:

- Choose the trading pair: For example, BTC/USDT.

- Define the Price Range: Set the highest and lowest prices where the bot will operate.

- Set the number of grids: This determines how many buy and sell orders will be placed within your price range. More grids equal more trades but smaller gains per trade.

- Decide on investment amount: How much do you want the bot to use?

Optional advanced settings:

- Stop-loss price: A safety net price where the bot stops trading to prevent more losses.

- Take-profit price: A target price where the bot stops trading to lock in profits.

Review & launch: Double-check everything and hit “Create” or “Start” to get the bot going.

Understanding grid trading

Grid trading lets you profit from market ups and downs by placing buy and sell orders at set intervals within a price range you choose. The bot buys low and sells high automatically within this range. It’s like having a tireless trader working for you 24/7.

How grid trading works

Here’s the gist:

- Price range: You set the upper and lower limits where you think the price will fluctuate.

- Grids: The bot splits this range into several levels.

- Buy orders: Placed at each grid level below the current price.

- Sell orders: Placed at each grid level above the current price.

- Execution: As the price moves, buy orders get filled when the price drops, and sell orders execute when the price rises.

Example:

- Price range: $18,000 to $22,000.

- Number of grids: 10.

- Grid size: The bot places buy and sell orders every $400.

- Operation: As the price moves within this range, the bot makes trades at these levels, aiming for small profits each time.

This strategy shines in a volatile but sideways market where prices swing up and down within a range. In other words, when the market can’t make up its mind, your bot is there to capitalize.

Tips for maximizing profits

1. Start small

If you’re new to this, begin with a small amount. No need to go all-in right away. This way, you can see how the bot works without putting a lot of money on the line. As you get the hang of it, you can up your investment.

2. Keep an eye on the market

Even though the bot does the trading, it’s a good idea to watch market trends. If things change a lot, you might need to tweak your price range and grid settings. For instance, if the market starts climbing, consider raising your upper price limit. After all, you don’t want to miss out on a bull run.

3. Diversify

Think about running multiple bots on different trading pairs or with different strategies. This spreads out your risk and can boost potential profits. Diversification helps cushion the blow if one market doesn’t go your way. It’s the old “don’t put all your eggs in one basket” wisdom.

4. Stay updated

Crypto markets can swing based on news and events. Keep yourself informed so you can adjust your strategies when needed. Follow reputable news sources and maybe join trading communities for insights. Knowledge is power, after all.

5. Reinvest profits

You might choose to reinvest the profits your bot makes to compound your earnings over time. This can help grow your portfolio faster. It’s like rolling a snowball down a hill—it just keeps getting bigger.

Advanced Strategies

1. Use technical indicators

Some bots let you add technical indicators like Moving Averages, RSI, or MACD to fine-tune your strategy. Mixing grid trading with technical analysis can boost your trading game. If you’re into charts and patterns, this is where you can geek out.

2. Backtest your strategies

Before you set your bot loose, use historical data to backtest your settings. This helps you see how your strategy might have performed in past market conditions. It’s like having a time machine for your trading plans.

3. Leverage with futures grid bot

Bybit offers a Futures Grid Bot that lets you trade with leverage. This can ramp up your profits but also increases risk. Make sure you understand how leverage works before jumping in. Remember, leverage is a double-edged sword.

4. Set conditional orders

Advanced users can set up conditional orders that only kick in when certain market conditions are met. This adds an extra layer to your trading strategy. Think of it as setting traps in the market—when the conditions are right, your bot springs into action.

Managing risk

Trading comes with risks, but here’s how you can keep them in check:

- Set stop-losses: Some bots let you set a stop-loss to exit a trade if the market turns against you by a certain amount.

- Use take-profit Llevels: Lock in gains by setting points where the bot will take profit and pause trading.

- Check performance regularly: Keep an eye on how your bot is doing and tweak as needed. Don’t just set it and forget it—this isn’t a rotisserie oven.

- Be careful with leverage: If you’re using leverage, tread carefully. It can amplify losses as well as gains.

- Stick to the plan: Avoid making knee-jerk reactions based on short-term market swings. Patience is a virtue in trading.

Common mistakes to avoid

1. Ignoring market trends

Setting up a grid bot without considering the overall market trend can lead to losses. For example, using a grid bot in a strong upward or downward trending market might not be effective. Don’t swim against the current.

2. Unrealistic price R\ranges

If your price range is too narrow or too wide, the bot might not perform well. Make sure your range reflects realistic price movements based on historical data and current conditions. Aim for the Goldilocks zone, not too hot, not too cold.

3. Overcomplicating strategies

While advanced settings can help, overcomplicating things can cause confusion and mistakes. Keep it simple, especially when you’re starting out. Complexity isn’t always your friend.

4. Neglecting security

Not securing your account can lead to unauthorized access. Always enable 2FA and follow best practices for account security. Better safe than sorry.

Advantages of Bybit trading bot over manual trading

- Speed: Bots execute trades faster than humans, which is crucial in fast-moving markets.

- Consistency: Bots stick to the plan, ensuring consistent execution.

- No emotional bias: Bots aren’t influenced by emotions that can lead to bad decisions.

- Handles complexity: Bots can manage multiple strategies at once, which is tough to do manually.

- Time saver: Free up your time for analysis, strategy development, or, you know, living your life.

Potential downsides

- Technical glitches: Like any software, bots can have bugs that affect performance.

- Market risks: Bots can’t predict crashes or extreme volatility. Sudden moves can lead to losses.

- Over-reliance: Depending solely on bots without understanding the market is risky. You should have a basic grasp of trading principles. Don’t put yourself on autopilot.

- Costs: While Bybit’s bot is free, trading fees still apply. Frequent trades can rack up fees that eat into profits.

- Security risks: If not properly secured, your account could be at risk. Always use strong passwords and enable security features.

Frequently Asked Questions (FAQs)

Is the Bybit trading bot free?

Yes, it’s free for all Bybit users. But remember, standard trading fees apply to each trade the bot makes.

Can I run multiple bots at once?

Absolutely. You can run multiple bots with different strategies or on different trading pairs to diversify your trading. The more, the merrier—as long as you can manage them.

Do I need to keep my computer on?

Nope. The bot runs on Bybit’s servers, so once it’s set up, it operates independently. Feel free to shut down and relax.

Is my investment safe?

While the bot automates trading, there are still risks due to market volatility. Only invest what you can afford to lose. It’s the golden rule of investing.

How do I stop the bot?

You can stop it anytime by going to the bot management section in your account and clicking “Stop” or “Terminate.” Easy peasy.

Conclusion

The Bybit trading bot is a game-changer, letting you earn money even when you’re not glued to your screen. By automating your strategies, you can seize market opportunities 24/7. Start small, keep learning, and tweak your strategies as you go.

Making money while you sleep isn’t a pipe dream anymore. With the right tools and approach, it’s totally doable. Just remember to stay informed, manage your risks, and keep refining your methods.

So, why not give the Bybit trading bot a shot? Set it up, let it do its thing, and see how it works for you. With some patience and practice, it might just become your favorite trading partner.

Don't miss a thing. Follow us on Telegram and Follow us on WhatsApp. If you love videos then also Subscribe to our YouTube Channel. We are on Twitter as MakeMoneyDotNG.