Martingale System: What is it and how does it work?

The Martingale System is a technique that is used by gamblers, but has been adopted as an investing technique, and is now being used by investors. This technique doesn’t rely on strategy or technique, but on luck so it is a highly unpredictable system to employ while investing. There is great risk involved, but if luck is on your side, you might end up with great winnings.

If you’re interested in finding out more about the Martingale System, including what is it and how it works, then keep reading.

What is the martingale system?

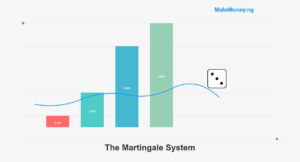

The martingale system is a method of investing where the size of the position grows as the size of the portfolio decreases, or the worth of investments continuously doubles after losses. It entails halving winning wagers and doubling losing wagers. The idea behind the technique is that you may change your fortune with only one lucky transaction or wager.

In essence, it is a tactic that encourages a loss-averse mindset that aims to raise the likelihood of recovering all your losses while simultaneously raising the possibility of suffering significant and rapid losses.

The fundamental tenet of the martingale system is, statistically speaking, you cannot lose all the time. Accordingly, you should raise the amount invested, even if it is losing value, in the hope that it will rise in the future.

Investors who use the martingale system are assumed to have an infinite amount of money to wager, or at least enough to reach the winning payout. If not, they might lose a lot of money after a few consecutive defeats under this method.

How it works in investing

Typically, the Martingale Strategy is used in any game where there is an equal chance of winning or losing. Markets are not zero-sum games, and this must be understood. Betting on markets is more complicated than on a roulette table. As a result, the technique is often adjusted before being used in stock markets.

Consider the following example: an investor using the martingale system buys $1,000 worth of shares at $100 per share. The price drops to $60 per share, so the investor buys more shares worth $2,000.

Assuming the stock price continues to decline, the trader buys another $4,000 worth of shares at $25. The average price per share is $34.5, and once the stock price exceeds this amount, the investor will start to make profits. Following the martingale system, the investor would wait until the stock price is 39.4 then leave with a $1,000 profit. However, the investor will be playing a losing game if the stock price continues to decline, and there is a chance that the company may go bankrupt. In this case, the investor will lose all his earnings.

Utilizing the martingale system in the stock market is complicated. If the probability of the various possibilities occurring is not equal, or if you lack the money to keep investing until you make a profit, it raises the possibility of suffering significant losses. Forex trading is a better fit for the martingale method than stock trading or casino gambling.

Consider a scenario where a forex trader utilizes the martingale system in trading. He makes a transaction with two equally likely outcomes; Outcome 1 where he makes a profit, and Outcome 2 where he makes a loss. In the hopes that outcome 1 would occur, Trader X chooses to trade a predetermined amount of $50. But instead, the transaction is lost and Outcome 2 takes place.

The transaction amount is raised to $100 using the Martingale Strategy in the hopes of achieving Outcome 1. Once again, the $100 is lost when Outcome 2 takes place. The deal is doubled to $200 since it represents a loss. Until the intended result is obtained, the procedure is repeated.

As you can see, the winning trade’s magnitude will be more than the total losses from all of the prior transactions.

The approach does improve the odds of winning in the near term, but it fails miserably in the long run, according to several studies that examine graphical martingale data.

Benefits

There are benefits to the martingale system, which is why investors use it. Let’s explore some of these benefits.

- Quickly cover losses: Its potential to provide a short-term gain is by far its greatest benefit. If players avoid going into a prolonged losing run, martingale may be successful.

- Possibility of making significant profits: As long as you have the financial resources to keep going and the odds are equal, you’ll eventually win a round. Because you double the amount you put in each time you lose, the amount you eventually win will cover all the losses you have made.

- Simple to comprehend: The technique is easy to understand, so experts and beginners alike can use it. You don’t need to be an expert in trading to use the technique, you just need to know the fundamentals and have the money to keep investing even when you make losses.

- You don’t need to time the market: The martingale system does not need you to know how the market works because it depends on luck and not strategy. So, if you have a hard time understanding market trends but have a lot of money to invest, then this strategy may work well for you.

Drawbacks

The martingale technique is a risky investing technique that has a lot of disadvantages. It may work for some, but most would find it too risky as an investment technique. Below are some of the major drawbacks of the Martingale system:

- You need a lot of money: If you want to utilize the martingale technique, you first have to ensure that you have sufficient funds to keep going until you win. If your money runs out before winning a turn, then you will end up losing a significant amount of money.

- The returns may not be worth the investment: Let’s say you start with an investment of $100 and you’re unlucky enough to go 9 rounds without winning, then win the 10th round. You would have spent $102,300 in total and made a sum of $102,400. Although you have managed to cover your losses, you made only $100 for all your time and money investment. If you had run out of money in the 9th round or any round before that, you would have ended up making significant losses.

- Trades may be subject to size constraints: This technique depends on you being able to invest an unlimited number of times, which would not work if there if there are constraints set on trades, which would prevent the trader from doubling their wager an unlimited number of times.

- Does not account for transactional expenses: The more you trade, the more you accrue transactional costs, which will be deducted from any profits you make in the end.

Conclusion

The martingale system is a strategy that may be used to increase the likelihood of winning after losing streaks. Since the technique is predicated on the idea that a single investment, or wager, cannot consistently lose, you will ultimately get your money back plus a profit if you keep increasing the same investment.

The martingale system is a method that performs well when used in conjunction with a trader’s arsenal of techniques, but it will ultimately fall short when used as the only foundation for trading.

On paper, the plan promises an unavoidable victory, regardless of the first defeats. Even while this could be the case, traders might be too far in the red to turn a profit.

This strategy may result in higher levels of risk than rewards and averages a somewhat smaller profit pool. The eventually profit that only amounts to the initial investment does not outweigh the possible losses because of this high risk-to-reward ratio.

Don't miss a thing. Follow us on Telegram and Follow us on WhatsApp. If you love videos then also Subscribe to our YouTube Channel. We are on Twitter as MakeMoneyDotNG.