Paga Vs OPay: Which is better?

Paga and Opay are on the top 10 list of popular fintech brands in Nigeria currently. With over 30 million customers, both companies have successfully warmed their way into the hearts of many Nigerians.

However, regardless of their collective impacts in the fintech industry, each company has unique plans for its esteemed customers. So, this article provides a comprehensive review of both companies, highlighting their pros, cons, services, and products; it also discusses the three significant factors to consider while looking for the best option for you.

Whether you’re a civil servant, entrepreneur, or artisan, this post will help you make informed decisions.

Paga Products and Services

Paga is a mobile money company that lets you transfer and receive money in Nigeria. Launched in February 2011, Paga is a secure platform that supports bill payments, airtime recharge, and other internet-based services.

With over 3 million users, Paga is no doubt one of the trusted mobile financial institutions in Nigeria.

Below is a list of products and services available to Paga users:

Money Transactions

Like many digital banks in Nigeria, money transfer and deposit are Paga’s main services. It lets you transfer money to any bank within the country, whether traditional or digital. You can also receive money in your wallet from anyone in the country.

Though Paga doesn’t support cross-border payments, you can receive money from foreign clients or families through their remittance services. However, the overseas-based sender must send through a Paga-supported/affiliated company like WorldRemit, Terrapay, and MoneyGlobe.

Additionally, Paga provides fast money withdrawal services. You can withdraw money from your Paga wallet into your bank account in less than five minutes.

Instant Bills Payment

Paga offers reliable and fast bill payment services to eligible users. With this service, you can pay for over 50 services in Nigeria, including electricity bills, TV cable subscriptions, internet, etc.

Interestingly, the payment process is simple and quick. Get the app and select the bills to pay. Alternatively, dial the designed USSD code and follow subsequent instructions.

Purchase Airtime

You can equally purchase airtime from different networks using your Paga account. Just dial the designated code, choose your preferred options and your mobile number will be credited.

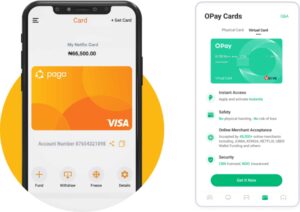

Paga Debit Card

Paga offers a debit card compatible with all commercial banks within Nigeria. Make online payments, fund your Paga wallet, and transfer money (at an atm stand) with the card.

Pros

Below are some exciting features and benefits you will enjoy using Paga:

- Affordable Charges: Paga services charges on local transactions are lower than many other platforms. Transferring money to a Paga bank is free, although it charges 7.5% VAT on every local transfer. We will talk more about charges later in the article.

- Top Convenience: Paga makes the list of financial institutions that provide top-level convenience for users. They offer both mobile and internet banking services to customers who have access to smartphones and their USSD banking can be used by those who can’t access the internet.

- Good Customer Support System: Paga has an impressive customer care system. Its FAQ web section answers common questions and difficulties you could face. You can explore the 24/7 online chat option if your problems are personal and urgent.

Additionally, Paga agents are all over the country, ready to help you create an account, resolve issues, and attend to all your queries.

Cons

These are some characteristics you may not like as a Paga customer.

- Limited International Transfer: Paga isn’t a good option for those working with an international brand.

- Relatively Excessive Charges: Though the fees are low, Paga’s charges are more; they deduct money for almost every activity, apart from P2P transfers. Likewise, third-party platforms also demand service charges before processing transactions to the Paga account. For instance, Moneytrans charges at least £2.01 to transfer money to a Paga account.

Opay Products and Services

Opay is one of the first fintech companies in Nigeria. Alongside PiggyVest and FirstMonie, they paved the way for other digital banks and mobile investment platforms in the country. Unsurprisingly, Opay boasts over 35+ million registered app users and 500,000+ agents in Nigeria alone.

Here are the services available to Opay customers:

Money Transfer and Deposit

Like Paga, all Opay customers can send and receive money into their Opay accounts. Whether you stay in Nigeria or abroad, you can send money to any Opay wallet/account with little stress.

Opay also guarantees a seamless withdrawal experience. It provides three withdrawal options, including card, Mobile app, and USSD.

Airtime/Data Purchase

Recharge your phone through the fast and easy airtime recharge option. This service is available to all network subscribers, including MTN, Glo, Airtel, and 9mobile.

Pay Bills

Like Paga, Opay provides an easy way to settle your electricity bills, TV cable subscriptions, and other bills. Visit their official page for a comprehensive list of supported service providers.

OWealth

This service allows users to save and invest their money and earn 15% annual interest on every saving. You can invest in Fixed Deposits, Mutual Funds, and other investment products to boost ROI.

Merchants Loans

This service grants users access to low-interest loans for business and personal use. However, every Opay loan attracts interest. A short-term loan accrues 3%, while a long-term loan comes with 15% interest.

POS Machine

Opay offers POS Machines to users willing to make extra money. With the product, you will also make payment easy for your customers. Interestingly, you don’t have to be an Opay agent to get the POS machine if you meet all the criteria.

Meanwhile, the Opay POS machine price ranges from ₦8500 (Opay Mini POS) to ₦50,000 (Smart POS), depending on your choice.

Pros

- Numerous products and services

- High transfer limit

- Top-level Security

- Quick transfer

Cons

- It doesn’t support direct transfers from abroad.

- Higher charges than many platforms.

Paga vs OPay: Direct Comparison

Below is the direct comparison of both platforms in different categories:

Service Charges

| Fees / Charges | Paga | Opay |

|---|---|---|

| User-to-user Transfer: | Free | ₦10 |

| Withdrawal Charges (to own bank): | Free | 0.5% on withdrawals below ₦20,000 ₦ 100 on ₦20k and above |

| Funding Account: | Free | ₦10 (₦5K and below) ₦20 (₦5K – ₦10K). ₦30 (10k and above) |

| ATM Transactions: | ₦100 | Same with above |

| Bills Payment: | ₦10 (N100 and below) ₦20 (N100 – 200) ₦30 (N201 – 400) ₦100 (N501 – 5 million) | 2% |

| Data: | Free | 3% (MTN) 4% ( Glo and Airtel) 4.5% 9Mobile commission |

Observation: Paga seems to be better than Opay in this category.

Products and Services

| Paga | Opay |

|---|---|

| Money Transfer | POS Machine |

| Bills Payments | Bills Payment |

| Data / Airtime | Merchants Loans |

| Debit Card | OWealth |

| Debit Card | |

| Money Transfer | |

| Data / Airtime |

Observation: Opay offers more services and products than Paga. Opay appears to be the best option for business owners.

Transfer / Transaction Limit

| Transfer limit (Level) | Paga | Opay |

|---|---|---|

| Level 1 | ₦3k per transfer N30,000 Daily | ₦20,000 per transfer ₦50,000 Maximum Daily. |

| Level 2 | ₦10,000 per transfer ₦100,000 maximum Daily | ₦50,000 per transfer ₦200,000 maximum daily. |

| Level 3 | ₦100,000 per transfer ₦1 million maximum daily | ₦1,000,000 per transfer ₦5,0000,000 maximum daily |

Observation: Opay offers higher transfer and transaction limits.

Factors to consider when choosing between both Digital Banks

Here are important factors that must influence your choice

Financial Status: How much do you intend to save in your account? How often do you make money — monthly or daily? This factor is crucial.

Business / Career: Consider your career or business and choose the most suitable option. For instance, Opay is better if you transfer a large amount of money regularly.

Security and Customer Care Support: You don’t want a situation where you will be stranded before someone attends to your problems. Based on research, these two banks have above-average customer service.

Conclusion

Every digital bank has its unique strengths and weaknesses. It’s left for you to research and consider which one meets your requirements. I hope this article provides all the information you need to make the right decision.

Sources

https://www.mypaga.com/paga-web/pc/terms.paga

https://swiftbills.ng/opay-pos-charges/

https://moneytransfers.com/companies/paga

https://www.opayweb.com/service-catalog